nc estimated tax payment safe harbor

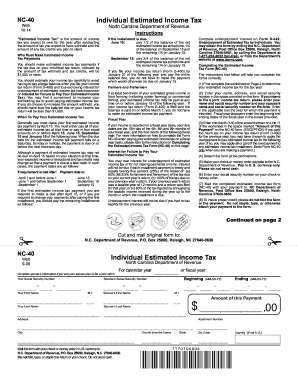

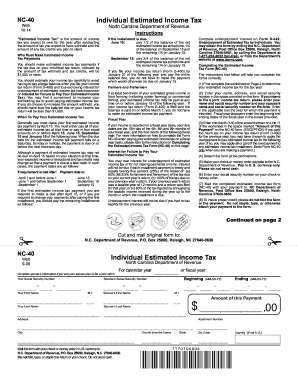

You must pay estimated tax payments for returns with taxable income of 50000 or more electronically. Instructions for Form NC-40 North Carolina Individual Estimated Income Tax.

What Does The March 1 Deadline Mean For Farmers Center For Agricultural Law And Taxation

About Form 8822-B Change of Address or Responsible Party - Business.

. Safe Harbor Rules. Safe harbor can be applied to estimated taxes giving you some leeway in how much you need to pay. The IRS has safe harbor methods for calculating your estimated tax payments.

If the total liability for the prior tax period or the projected liability for the current tax period is not 5000 or more. The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up. The safe harbor rules are as follows.

110 of the prior years tax liability. If you do youll owe penalties 14 to 1 of the amount owed for each month it is owed and interest at the rate of the federal short-term rate currently around 025- plus 3. Expand all Collapse all.

If your previous years adjusted gross income was more than 150000 or 75000 for those who are married and filing separate returns last year you will have to pay in 110 percent of your previous years taxes to satisfy the safe-harbor requirement. North carolina safe harbor estimated tax. If youre estimating a down year so long as you pay within 90 of your actual liability for the current year youre safe.

North carolina safe harbor estimated tax. 90 of the current years tax liability or. The tax system is a pay-as-you-go system.

You cant just wait until April 15th and pay your tax bill. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe.

Quarterly payments of the estimated franchise and excise taxes. You can also pay your estimated tax online. Federal Tax Back to discussions.

If you expect to owe less than 1000 after subtracting your withholding youre safe. Here is the main part of the Safe Harbor Rule. The amount of any credits.

The safe harbor rule of estimated tax payments paying 100 of the taxes you owed in the previous year is sometimes referred to as the safe harbor rule. No penalty is imposed if the amount paid for the current year is equal to at least 90 of the taxpayers current tax liability. Income Tax Return for Electing Alaska Native Settlement Trusts.

Safe harbor on estimated taxes Richard Margelefsky 01-21-2014 1150 AM the question is if paying this year estimated taxes and covering prior years tax. There has been no change in the safe harbors for Estimated Payment of Individual Income Tax for tax year 2011. If its easier to pay your estimated taxes weekly bi-weekly monthly etc.

If you follow these methods you wont be subject to additional interest and penalties even if you still owe tax when you file your return. If your adjusted gross income AGI was less than 150000 last year then youll need to make quarterly estimated payments that total the smaller of 100. Safe harbor on estimated taxes Richard Margelefsky 01-21-2014 1150 AM.

Safe harbor estimates calculate at 110 of current year tax for returns with federal taxable income over 150000 only when code. District of Columbia Safe Harbor Rules. Estimated tax payment safe harbor details.

About Form 1041-N US. If you expect to owe less than 1000 after subtracting your withholding youre safe. If your adjusted gross income for the year is over 150000 then you must pay at least 110 of last years taxes.

Estimated Income Tax is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim. If your adjusted gross income for the year is over 150000 then its 110. Nc Estimated Tax Payment Safe Harbor.

Note however that the surviving spouse may need to make estimated payments for his or her own tax liability Even if the deceased taxpayer was taking advantage of the prior-year-tax safe harbor in making estimated tax payments and the Form 1040 ends up with a balance due later on the tax preparer can eliminate filing the Form 2210 Underpayment of. Using EFTPS you can access a history of your payments so. You can as long as youve paid enough in by the end of the quarter.

More after applicable credits for both the prior tax year and current tax year must make quarterly estimated tax payments. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. However these safe harbors do not apply if the prior years adjusted gross income is over 150000 in which case the safe harbors are.

About Form 1041-T Allocation of Estimated Tax Payments to Beneficiaries. The safe harbor estimated tax. Section 6655 of the Internal Revenue Code IRC generally requires corporations to make quarterly estimated tax payments of at least 25 of the required annual payment in order to avoid an underpayment penalty.

North Carolina Individual Estimated Income Tax. Thus a true safe harbor regardless to the current years tax liability would be withholding and estimated tax payments. The question is if paying this year estimated taxes and covering prior years tax.

Make ALL of your federal tax payments including federal tax deposits FTDs installment agreement and estimated tax payments using EFTPS. You did not have a tax liability in 2010 If you did not owe taxes a year ago you will not be penalized for underpayment this. Taxpayers are required to make estimated tax payments when there is a combined franchise and excise tax liability of 5000 or more after applicable tax credits for boththe prior tax year annualized if the tax period was less than 12 months and the current tax year.

For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year. When to Make Payments. Monday April 11 2011.

And if certain conditions are met your penalty is waived or reduced. Check North Carolina does not have vouchers to send with estimates. The estimated safe harbor rule has three parts.

100 of the prior years tax liability. Estimated tax safe harbor. The safe harbor rule of estimated tax payments.

How To Calculate Estimated Taxes The Motley Fool

Understanding Individual Estimated Income Tax Payments And Safe Harbors Dermody Burke Brown Cpas Llc

What If You Haven T Paid Quarterly Taxes Mybanktracker

Safe Harbor For Underpaying Estimated Tax H R Block

Tangible Property Regulations Safe Harbor Elections In Drake Software

Estimated Tax Payments For Independent Contractors A Complete Guide

Nc Estimated Tax Payment Fill Out And Sign Printable Pdf Template Signnow

Safe Harbor For Underpaying Estimated Tax H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller

Quick And Dirty Payroll For One Person S Corps Evergreen Small Business

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller